WHY EVERY BUSINESS NEEDS A CFO

Overwhelmed Business Woman

Many business owners don’t know they are missing an essential aspect of their business: finance. They have a bookkeeper who handles “the numbers” and a CPA who files taxes. But that’s it. No one is doing financial strategy.

“I had my business for 10 years before I understood that,” Amelia Forczak, the founder of Pithy Wordsmithery, told me recently. Why don’t many small and medium-sized businesses have a Chief Financial Officer (CFO)? And why does it matter?

The CFO is a key business partner who:

Uses their business experience and financial knowledge to guide the leadership team.

Manages a diverse range of critical accounting and finance activity

Provides insight into future performance, mitigates risks, and helps achieve objectives.

Without a CFO, who else fills this critical role?

Financial Surprises Happen Far Too Often

Years ago, a banker I met shared the story of a business owner turned down for a loan. They had been in business for years, regularly reviewed monthly reports, and were confident when submitting their application. Two weeks later, they were shocked to learn they were turned down. Sales and profits had both declined eight quarters in a row. “That can’t be! Our accountant is a friend and surely would have told us!”

The CFO role is meant to ensure there are no financial surprises. Good or bad! Unfortunately, they happen far too often, and there are several reasons:

Outsourced Trust – Owners often believe that their accountant, banker, or tax advisor cares as much as they do about their business. They certainly do care. But the reality is that they work with a lot of other businesses. None of them focus on a single business every week.

Accounting is a Mystery – Owners start their business with a passion for doing their particular thing. Not “numbers.” They don’t understand accounting, much less enjoy it. That’s why accounting is typically the first thing they outsource. Ask any banker or accountant, and you’ll hear story after story of business owners who lack interest or curiosity about their numbers.

Success – “We’re growing and profitable!” That mindset may work for a while, but their accounting and finance needs will become more complex as their business grows.

What Exactly is Finance? – In many situations, owners are unaware of the difference between accounting and finance. Like marketing and sales, they are closely related. But they are very different functions, with different roles and value contributions.

The bottom line is if your business does not have a dedicated finance partner, a complete understanding of accounting results, a continual improvement mindset, and even basic financial processes in place, a surprise will happen. It’s a matter of when and how bad.

How to Know When You Need a CFO?

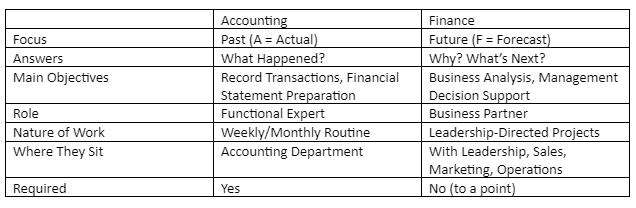

To know when you need a CFO, it’s essential to understand the main difference between accounting and finance, which is not often discussed. Accounting is required. Finance is optional (to a point).

This distinction makes sense if you think about the typical growth of a business. No matter how small, basic accounting must be done to invoice clients, pay bills, record expenses, and pay taxes. The owner may do some of this, or it is outsourced. As the business grows, a clerk or accountant is hired. Roles and complexity expand to a senior accountant and eventually require a controller to manage an accounting team. Often, it is only after this stage that a fractional or full-time CFO is hired.

The CFO is responsible for all accounting and financial reporting, banking, insurance, employee benefit plans, and other responsibilities. They are also members of the leadership team and play a key role in guiding the future of the business. When they need help with this future-focused work, voila! The finance function begins!

At this point, finance becomes required. A financial team is started to lead business analysis and forecasts, create information to support decisions, provide investment analysis, and support strategic planning. While the finance function may be optional for many small and medium-sized companies, it is a requirement for every large business.

This evolution of finance will vary significantly from business to business. It depends on the owner’s background, comfort with numbers, industry, etc. But it is always driven by leadership’s need for a “future-focused” finance partner.

Accounting and Finance – A Contrast of Differences

As noted above, the CFO leads two separate disciplines, Accounting and Finance. The people working in each have different skill sets and mindsets. They both play a vital role but create value in different ways. Depending on the company, the lines between them can get pretty blurry.

With that in mind, it is helpful to contrast the differences between accounting and finance.

Focus - By the nature of its work, accounting generally deals with the past. It’s a rear-view mirror. Accounting = Actual = Ago.

Finance uses accounting and other business data to create information to guide the future. Finance = Future. The future also encompasses an owner’s fear and the business’s fortune or failure.

Answers Provided – Accounting reports history. Most accounting transactions record what happened. The “Big 3” financial statements (Income Statement, Balance Sheet, and Cash Flow Statement) present results up to today and earlier. They tell you “what?”.

What were sales and profits?

How much cash do we have?

Did inventory values increase or decrease?

Was spending in line with prior months?

Financial analysis digs deeper to understand “what’s the cause?” and offers advice for “what’s next?”

Why did we hit or miss sales and profit projections, what should we adjust?

When will we need to use our line of credit, can we defer expenses now?

Why did gross margins change, what do we need to change?

What is the rate of return on a project, should we invest?

What customer segments or products are the most profitable, how do we improve?

Rhythm & Role – Accountants tend to be managed by the calendar. Prepping for month-end and then completing month-end reporting and reconciliations can consume several days if not weeks. There is an established rhythm of work that must be done every month in addition to the daily routine processes. Accounting is structured and more technical. Finance also has monthly routines, including performance reviews and KPI (Key Performance Indicators) updates. However, much of their work is special projects that help the CFO provide answers to the business.

Matching Your CFO to Your Business Needs

Business owners and leaders think and worry about the future. Eventually, they will recognize they need a more engaged financial expert on their team. They need a CFO.

The first question is: Full-Time or Fractional? This will depend on how much they are prepared to invest in a CFO and if a full 40-50 hours of work per week. If full-time, you must also consider the CFO will be asking questions that someone must answer. Plan to add at least one analyst eventually.

A fractional CFO is a cost-efficient alternative for smaller and growing businesses. With this part-time model, scope and priorities must be identified and agreed upon. Unless a great team is already in place, a part-time CFO cannot do justice to the full range of responsibilities.

In this case, matching the business needs to any Fractional CFO’s experience and expertise will be critical. There are two general ways to think about your candidates:

Technical Accounting Focus – A CFO who began their career as an accountant, then a comptroller, then a CFO, will have expertise biased to accounting. They may tend to be structured thinkers and more risk-averse. It is a great fit to improve accounting work processes, cost savings, and manage compliance and plans.

Financial Planning & Analysis Focus – A CFO with a Finance focus will typically have gained a solid understanding of accounting processes and requirements but not depth of technical expertise. They tend to be more strategic and creative thinkers, adaptable, and risk-tolerant. Best fit if you need to start building the “forward-focus” to support strategic planning, implement KPI dashboards, or provide financial leadership and education to other business leaders.

It’s never an either/or between the two, but you will benefit by exploring each potential CFO’s balance.

Do You Have the Right Seat on The Bus?

As a business leader, you know the importance of having the right people on the bus. And in the right seat. In today’s uncertain environment, it’s even more important to ask: Do We Have the Right Seat?

The answer is no if you do not have a CFO on the bus.

Data2Profit offers Fractional CFO services with an FP&A focus. If that fits what you may now recognize you need or want to learn more, click the link below.